Just How Medicare Supplement Can Enhance Your Insurance Policy Insurance Coverage Today

As individuals browse the intricacies of medical care strategies and look for thorough protection, recognizing the nuances of extra insurance becomes significantly essential. With an emphasis on bridging the voids left by standard Medicare plans, these additional options supply a customized approach to meeting specific needs.

The Fundamentals of Medicare Supplements

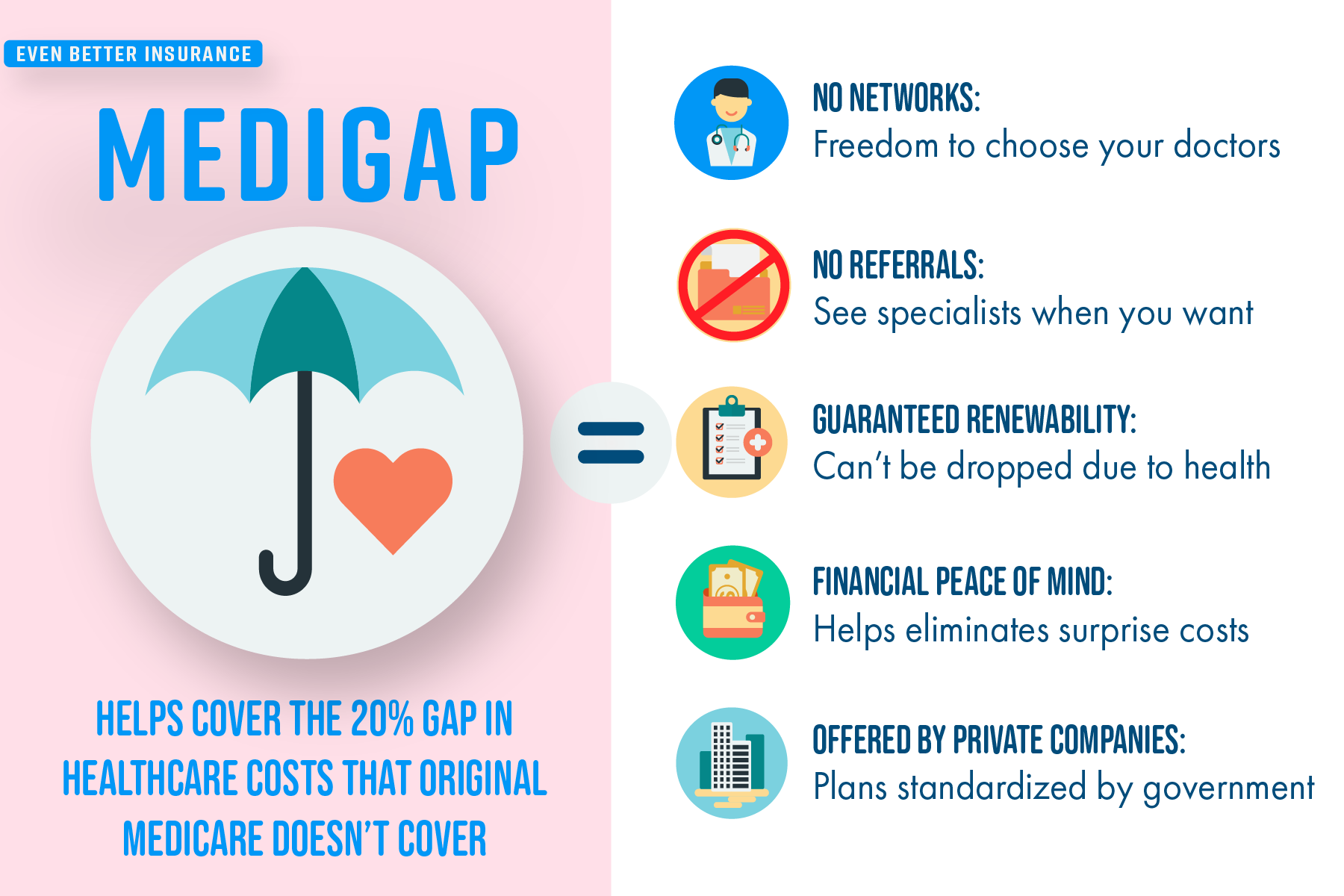

Medicare supplements, additionally called Medigap strategies, provide extra protection to load the gaps left by original Medicare. These auxiliary plans are used by exclusive insurance provider and are created to cover costs such as copayments, coinsurance, and deductibles that are not completely covered by Medicare Component A and Part B. It's necessary to note that Medigap plans can not be utilized as standalone plans but work along with initial Medicare.

One key facet of Medicare supplements is that they are standardized across the majority of states, using the same basic advantages no matter the insurance policy provider. There are ten various Medigap strategies identified A with N, each supplying a different level of coverage. For example, Plan F is among one of the most extensive alternatives, covering practically all out-of-pocket expenses, while other plans might provide a lot more restricted coverage at a lower costs.

Understanding the fundamentals of Medicare supplements is critical for individuals approaching Medicare eligibility that want to improve their insurance coverage and minimize prospective financial burdens connected with medical care costs.

Recognizing Protection Options

Exploring the varied variety of protection alternatives offered can provide useful understandings right into supplementing health care expenses effectively. When thinking about Medicare Supplement intends, it is critical to understand the various coverage choices to make certain extensive insurance policy protection. Medicare Supplement plans, also called Medigap policies, are standard throughout most states and identified with letters from A to N, each offering differing levels of insurance coverage. These strategies cover copayments, coinsurance, and deductibles that Original Medicare does not fully pay for, supplying recipients with financial safety and assurance. In addition, some plans may provide insurance coverage for solutions not consisted of in Initial Medicare, such as emergency treatment during international traveling. Recognizing the insurance coverage options within each plan type is vital for people to select a policy that aligns with their particular health care requirements and budget plan. By very carefully analyzing the protection alternatives readily available, recipients can make enlightened choices to improve their insurance policy coverage and successfully take care of medical care prices.

Advantages of Supplemental Plans

Understanding the significant benefits of additional plans can brighten the value they bring to people seeking enhanced medical care protection. One key advantage of additional strategies is the monetary security they provide by helping to cover out-of-pocket costs that original Medicare does not fully spend for, such as deductibles, copayments, and coinsurance. This can lead to significant financial savings for insurance policy holders, particularly those who call for regular clinical services or therapies. Additionally, additional plans use a broader variety of coverage options, including accessibility to doctor that may not approve Medicare job. This versatility can be crucial for individuals that have specific health care needs or choose particular medical professionals or experts. An additional advantage of additional strategies is the capacity to travel with assurance, as some strategies provide insurance coverage for emergency medical solutions while abroad. On the whole, the benefits of additional strategies add to an extra extensive and tailored visite site technique to medical care coverage, making sure that people can obtain the treatment they need without encountering frustrating financial concerns.

Cost Considerations and Savings

Offered the monetary safety and wider coverage choices supplied by additional strategies, an important facet to take into consideration is the price factors to consider and potential savings they supply. While Medicare i loved this Supplement intends call for a month-to-month premium along with the typical Medicare Component B premium, the advantages of decreased out-of-pocket costs usually exceed the added expenditure. When assessing the cost of extra plans, it is essential to contrast premiums, deductibles, copayments, and coinsurance throughout various plan kinds to figure out the most economical option based upon individual medical care needs.

By selecting a Medicare Supplement strategy that covers a greater percent of medical care expenditures, individuals can minimize unforeseen expenses and budget plan a lot more properly for clinical treatment. Inevitably, spending in a Medicare Supplement strategy can supply beneficial economic defense and tranquility of mind for recipients looking for thorough insurance coverage.

Making the Right Selection

With a range of strategies look what i found readily available, it is critical to assess elements such as protection options, costs, out-of-pocket costs, supplier networks, and overall value. In addition, evaluating your budget plan constraints and contrasting premium costs amongst different plans can help make sure that you select a strategy that is budget-friendly in the long term.

Final Thought